In compliance with the Rules and Guidelines of Disclosure, Sembcorp Salalah Power and Water Co SAOG (“the Company”) discloses the following: On 25 May 2018, Cyclone Mekunu storm made landfall near Salalah. The Company, with the help of its staff, took all necessary measures to minimize the impact of the Cyclone. Our preliminary assessment is that the total impact due to Cyclone is not expected to be material. However, the total impact of the Cyclone on plant operations cannot yet be precisely assessed at this point in time. The company is producing power and delivering to Dhofar grid. Our water production plant is temporarily shut down due to a severe worsening of sea conditions during the cyclone, conditions that still persist.

target="_blank" rel="noopener"> Download

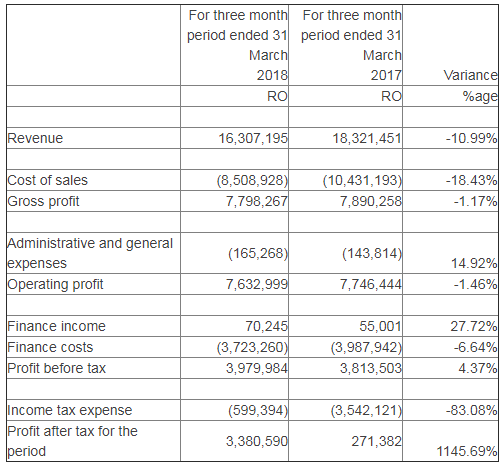

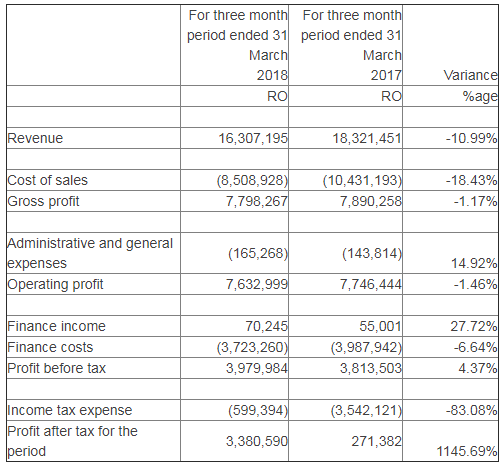

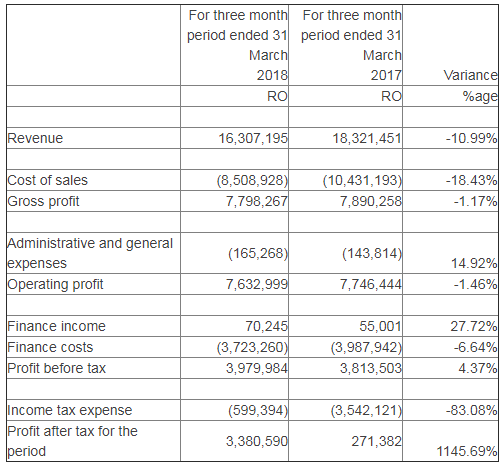

DownloadThe Board of Directors of Sembcorp Salalah Power & Water Company SAOG (“the Company”) is pleased to advise the Capital Market Authority, the Muscat Securities Market and the investor community of the following material resolutions made at the meeting of the Board of Directors (the “Board”) held on 27 April 2018: The Board approved and authorised for issuance the Company’s Financial Statements and Management Report for the period ended 31 March 2018.

target="_blank" rel="noopener"> Download

Download

1. The report of the Board of Directors of the Company for the year ended 31 December 2017 was approved.

2. The report on the evaluation of the performance of the Board of Directors for the financial year ended on 31 December 2017 was approved

3. The report on Corporate Governance for the financial year ended 31 December 2017 was approved.

4. The financial statements (Balance Sheet and Profit & Loss Account) of the Company for the financial year ended 31 December 2017 was approved.

5. A proposed cash dividend of 3.1% of the share capital (equivalent to 3.1 Baizas per share) to shareholders listed in the shareholders’ register maintained by the Muscat Clearing and Depository Company SAOC as at 1 April 2018 was approved.

6. The shareholders authorised the Board of Directors of the Company to approve the payment of an interim dividend up to 10% (equivalent to 10 Baizas per share) of the issued share capital of the Company, from the audited accounts of the Company for the nine-month period ending September 30, 2018 to shareholders listed in the shareholders’ register maintained by the Muscat Clearing and Depository Company SAOC as on 1 November 2018

7. The sitting fees for the Directors and the Sub-Committees of the Board for an amount of RO 20,500 for the financial year ended 31 December 2017 and the proposed sitting fee for the financial year 2018 was approved.

8. The Directors’ remuneration of RO 67,240 for the financial year ended 31 December 2017 was approved.

9. The transactions and contracts entered into by the Company with related parties, for the financial year ended 31 December 2017 were approved.

10. The proposed transactions and contracts to be entered into by the Company with related parties, for the financial year ending 31 December 2018 were approved.

11. The donation of RO 40,119 made to support community services during the financial year ended 31 December 2017 was approved.

12. A budget of RO 60,000 for the financial year 2018 towards charitable expenses was approved.

13. The appointment of KPMG as independent third party to evaluate the performance of the Company and their remuneration was approved

14. The appointment of PriceWaterhouseCoopers as the auditors of the Company for the financial year 2018 and their remuneration was approved.

target="_blank" rel="noopener">

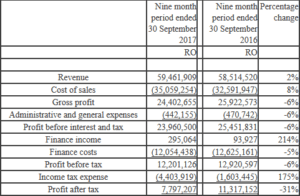

The above reported numbers represent initial unaudited financial results and are subject to approval and confirmation by the Company’s Audit Committee and Board of Directors.

The Board of Directors of Sembcorp Salalah Power & Water Company SAOG (“the Company”) is delighted to invite the shareholders of the Company to attend the annual general meeting (Meeting) to be held at 3.00 p.m. on Thursday 8 March 2018 at Hormuz Grand Hotel, Muscat, Sultanate of Oman, to discuss the following agenda:

Agenda for the Annual General Meeting

1 To consider and approve the Report of the Board of Directors for the financial year ended 31 December 2017.

2 To approve the report on the evaluation of the performance of the Board of Directors for the financial year ended on 31 December 2017.

3 To consider and approve the Corporate Governance Report for the financial year ended 31 December 2017.

4 To consider the Auditor’s Report and approve the financial statements (Balance Sheet and Profit and Loss Account) for the financial year ended 31 December 2017.

5 To consider and approve the recommendation to distribute cash dividends at the rate of 3.1% of the capital (being 3.1 baisas per share) to shareholders listed in the shareholders’ register maintained by the Muscat Clearing and Depository Company SAOC as at 1 April 2018.

6 To authorize the Board of Directors to approve the payment of an interim dividend of up to 10% of the issued share capital of the Company (being 10 baisas per share) (from the audited accounts of the Company for the nine-month period ending on 30 September 2018) to shareholders listed in the shareholders’ register maintained by the Muscat Clearing and Depository Company SAOC as at 1 November 2018.

7 To consider and ratify the directors’ and committees’ sitting fees received in the previous financial year and determine the sitting fees for the next financial year.

8 To consider and approve directors’ remuneration amounting to RO 67,240 for the financial year ended on 31 December 2017.

9 To consider and ratify the related party transactions entered into during the financial year ended on 31 December 2017.

10 To consider and approve the related party transactions proposed to be entered into during the financial year ending on 31 December 2018.

11 To inform the meeting of the donations made to support community services during the financial year ended on 31 December 2017.

12 To consider and approve a proposal to spend the total sum of RO 60,000 to support community services during the financial year ending on 31 December 2018.

13 To appoint an independent entity to evaluate the performance of the directors for the financial year ending on 31 December 2018 and determine their fees.

14 To appoint the auditors of the Company for the financial year ending on 31 December 2018 and determine their fees.

Pursuant to the Articles of Association of the Company, any shareholder has the right to appoint a proxy in writing to attend and vote on decisions taken on his behalf. The proxy should carry the authorised proxy card attached with the notice to attend the general meeting as issued by Muscat Clearing and Depository Company SAOC. If the shareholder is a natural person, he is required to attach with the proxy card a copy of ID for adults, passport for females and minors who do not have an ID card, and resident cards or passports for expatriates. If the shareholder is a juristic person, the proxy card shall be signed by an authorised signatory and sealed with the company’s seal and submitted together with a copy of the commercial registration certificate.

All invitees are requested to attend the meetings at least half an hour before the meeting time.

If you have any inquiries kindly contact Tariq Bashir on telephone number 93215022.

Download

DownloadThe above reported numbers represent initial unaudited financial results and are subject to approval and confirmation by the Company’s Audit Committee and Board of Directors.

The Board of Directors of Sembcorp Salalah Power & Water Company SAOG (“the Company”) is pleased to advise the Capital Market Authority, the Muscat Securities Market and the investor community of the following material resolutions made at the meeting of the Board of Directors (the “Board”) held on 13 February 2018:

The Board approved and authorised for issuance the Company’s Financial Statements and annual report for the year 2017;

The Board approved the Code of Corporate Governance report for the year 2017;

The Board proposed the distribution of final cash dividend of Baizas 3.1 per share (3.1% of issued share capital), giving a total dividend for 2017 of Baizas 10.3 per share to the Shareholders who are registered in the Company Shareholders’ register with Muscat Clearance & Depository Company SAOC on 1 April 2018;

The Board will seek Shareholders’ authorisation at the Annual General Meeting to approve the payment of an interim dividend not exceeding Baizas 10 per share (10% of the issued share capital of the Company) for the nine month period ending 30 September 2018, to shareholders listed in the shareholders’ register maintained by the Muscat Clearing and Depository Company SAOC as at 1 November 2018.

Download

DownloadThe above reported numbers represent initial unaudited financial results and are subject to approval and confirmation by the Company’s Audit Committee and Board of Directors.

Note: Significant increase in income tax expense is due to one off deferred tax expense impact arising from change of tax law in Oman.

The above reported numbers represent initial unaudited financial results and are subject to approval and confirmation by the Company’s Audit Committee and Board of Directors.

Note: Significant increase in income tax expense is due to one off deferred tax expense impact arising from change of tax law in Oman.

The above reported numbers represent initial unaudited financial results and are subject to approval and confirmation by the Company’s Audit Committee and Board of Directors.

|

For three month period ended 31 March 2017 |

For three month period ended 31 March 2016 |

Percentage change |

|

|

RO |

RO |

||

| Revenue |

18,321,451 |

17,723,207 |

3.38% |

| Cost of sales |

(10,431,193) |

(9,664,895) |

7.93% |

| Gross profit |

7,890,258 |

8,058,312 |

-2.09% |

| Administrative and general expenses |

(143,814) |

(206,054) |

-30.21% |

| Profit before interest and tax |

7,746,444 |

7,852,258 |

-1.35% |

| Finance income |

55,001 |

22,628 |

143.07% |

| Finance costs |

(3,987,942) |

(4,263,512) |

-6.46% |

| Profit before tax |

3,813,503 |

3,611,374 |

5.60% |

| Income tax expense (note) |

(3,542,121) |

(434,532) |

715.16% |

| Profit after tax for the year |

271,382 |

3,176,842 |

-91.46% |

- The report of the Board of Directors of the Company for the year ended 31 December 2016 was approved.

- The report on Corporate Governance for the financial year ended 31 December 2016 was approved.

- The financial statements (Balance Sheet and Profit & Loss Account) of the Company for the financial year ended 31 December 2016 was approved.

- A proposed cash dividend of 3.6% of the share capital (equivalent to 3.6 Baizas per share) to shareholders listed in the shareholders’ register maintained by the Muscat Clearing and Depository Company SAOC as at 2 April 2017 was approved.

- The shareholders authorised the Board of Directors of the Company to approve the payment of an interim dividend up to 10.4% (equivalent to 10.4 Baizas per share) of the issued share capital of the Company, from the audited accounts of the Company for the nine-month period ending September 30, 2017 to shareholders listed in the shareholders’ register maintained by the Muscat Clearing and Depository Company SAOC as on 1 November 2017

- The sitting fees for the Directors and the Sub-Committees of the Board for an amount of RO 25,750 for the financial year ended 31 December 2016 and the proposed sitting fee for the financial year 2017 was approved.

- The Directors’ remuneration of RO 91,000 for the financial year ended 31 December 2016 was approved.

- The transactions and contracts entered into by the Company with related parties, for the financial year ended 31 December 2016 were approved.

- The proposed transactions and contracts to be entered into by the Company with related parties, for the financial year ending 31 December 2017 were approved.

- The donation of RO 34,000 made to support community services during the financial year ended 31 December 2016 was approved.

- A budget of RO 42,000 for the financial year 2017 towards charitable expenses was approved.

- The criteria to appraise the board of directors’ performance was approved.

- The appointment of Moore Stephens as independent third party to evaluate the performance of the Company and their remuneration was approved

- The appointment of PriceWaterhouseCoopers as the auditors of the Company for the financial year 2017 and their remuneration was approved.

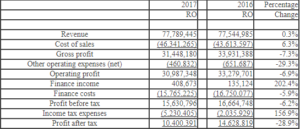

| All figures in OMR millions |

For the year ended 31 December 2016 |

For the year ended 31 December 2015 |

Percentage change |

| Total revenue |

77.545 |

73.621 |

5.33% |

| Total expenses* |

(62.916) |

(59.977) |

4.90% |

| Net profit after tax |

14.629 |

13.644 |

7.22% |

- The Board appointed Mr. Tan Cheng Guan as Chairman;

- The Board appointed Mr. Kalat Ghuloom Al Bulooshi as Deputy Chairman;

- The Board appointed Mr. Tariq Bashir as Company Secretary and Mr. Lim Yeow Keong as Disclosure Officer of the Company; and

- The Board appointed following board members as members of the Audit committee and Nomination and Remuneration Committee.

| Committee | Chairman | Members |

| Audit Committee | Mr. Tariq Al Amri | Mr. Quek Hong Liat and Mr. Ahmed Al Bulushi |

| Nomination and Remuneration Committee | Mr. Kalat Al-Bulooshi | Mr. Ng Meng Poh and Hassan Al Nassay |

| Mr. Tan Cheng Guan |

| Mr. Ng Meng Poh |

| Mr. Quek Hong Liat |

| Mr. Hassan Ismail Salman Al Nassay |

| Mr. Kalat Ghuloon Al Bulooshi |

| Mr. Tariq Al Amri |

| Mr. Abdul Amir Saied Mohammed |

| Mr. Ahmed Ali Sulaiman Al Bulushi |

| Mr. Khalid Ali Al Hamoodah |

| The Board of Directors of Sembcorp Salalah Power & Water Company SAOG (“the Company”) is delighted to invite the shareholders of the Company to attend the annual general meeting and extraordinary general meeting to be held at 3.00 p.m. on Tuesday 15 March 2016 at Hormuz Grand Hotel, Muscat to discuss the following agenda: |

| First: Agenda for the Extraordinary General Meeting |

| 1 To approve the amendment of the par value of each share from RO 1 to 100 baisa per share and to amend the Articles of Association accordingly. This resolution shall result in splitting one share into ten shares for the registered shareholders of the Company on the date of the Extraordinary General Meeting that approves this decision, and amending the issued share capital from 95,457,195 shares to 954,571,950 shares and the authorised share capital from 100,000,000 shares to 1,000,000,000 shares. |

| Second: Agenda for the Annual General Meeting |

| 1 To consider and approve the Report of the Board of Directors for the financial year ended 31 December 2015. |

| 2 To consider and approve the Corporate Governance Report for the financial year ended 31 December 2015. |

| 3 To consider the Auditor’s Report and approve the financial statements (Balance Sheet and Profit and Loss Account) for the financial year ended 31 December 2015. |

| 4 To consider and approve the recommendation to distribute cash dividends at the rate of 3.5% of the capital (being 3.5 baisas per share) to shareholders listed in the shareholders’ register maintained by the Muscat Clearing and Depository Company SAOC as at 3 April 2016. |

| 5 To authorize the Board of Directors to approve the payment of an interim dividend of up to 10.3% of the issued share capital of the Company (being 10.3 baisas per share) (from the audited accounts of the Company for the nine-month period ending on 30 September 2016) to shareholders listed in the shareholders’ register maintained by the Muscat Clearing and Depository Company SAOC as at 1 November 2016. |

| 6 To consider and ratify the directors’ and committees’ sitting fees received in the previous financial year and determine the sitting fees for the next financial year. |

| 7 To consider and approve directors’ remuneration amounting to RO 100,000 for the financial year ended on 31 December 2015. |

| 8 To consider and ratify the related party transactions entered into during the financial year ended on 31 December 2015. |

| 9 To consider and approve the related party transactions proposed to be entered into during the financial year ending on 31 December 2016. |

| 10 To inform the meeting of the donations made to support community services during the financial year ended on 31 December 2015. |

| 11 To consider and approve a proposal to spend the total sum of RO 42,000 to support community services during the financial year ending on 31 December 2016. |

| 12 To appoint the auditors of the Company for the financial year ending on 31 December 2016 and determine their fees. |

| 13 To elect a new Board of Directors for the Company composed of nine new members. Any person who wishes to nominate himself/herself to the Board of Directors should complete a nomination form available from the Company. The nomination form will be sent to any shareholder on request. The completed form should be delivered to the Company at least two working days prior to the Annual General Meeting (no later than Thursday 10 March 2016). The Company will not accept any applications received after this date. |

| Pursuant to the Articles of Association of the Company, any shareholder has the right to appoint a proxy in writing to attend and vote on decisions taken on his behalf. The proxy should carry the authorised proxy card attached with the notice to attend the general meeting as issued by Muscat Clearing and Depository Company SAOC. If the shareholder is a natural person, he is required to attach with the proxy card a copy of ID for adults, passport for females and minors who do not have an ID card, and resident cards or passports for expatriates. If the shareholder is a juristic person, the proxy card shall be signed by an authorised signatory and sealed with the company’s seal and submitted together with a copy of the commercial registration certificate and authorised signatories form. |

| All invitees are requested to attend the meetings at least half an hour before the meeting time. |

| If you have any inquiries kindly contact Tariq Bashir on telephone number 93215022. |

|

Unaudited 2015 |

Audited 2014 |

||

|

RO |

RO |

||

| Revenue |

73,620,776 |

62,770,756 |

|

| Cost of sales |

(39,704,971) |

(29,186,960) |

|

| Gross profit |

33,915,805 |

33,583,796 |

|

| Administrative and general expenses |

(532,616) |

(1,059,824) |

|

| Other income |

1,583 |

1,683,569 |

|

| Operating profit |

33,384,772 |

34,207,541 |

|

| Finance income |

90,182 |

134,307 |

|

| Finance costs |

(17,905,289) |

(19,776,946) |

|

| Profit before tax |

15,569,665 |

14,564,902 |

|

| Income tax |

(1,872,440) |

(1,751,602) |

|

| Profit after tax |

13,697,225 |

12,813,300 |

|

| Other comprehensive income (loss), net of income tax: | |||

| Item that are or may be classified to profit or loss | |||

| Effective portion of change in fair value of cash flow hedge |

2,032,336 |

(3,263,949) |

|

| Total comprehensive income for the year |

15,729,561 |

9,549,351 |

|

| Earnings per share: | |||

| Basic earnings per share |

0.14 |

0.13 |

| All figures in OMR millions |

9 month period ended 30 September 2015 |

9 month period ended 30 September 2014 |

Percentage change |

| Total revenue |

55.033 |

47.631 |

15.54% |

| Total expenses* |

-44.418 |

-37.123 |

19.65% |

| Net profit after tax |

10.615 |

10.508 |

1.02% |

| All figures in OMR millions |

6 month period ended 30 June 2015 |

6 month period ended 30 June 2014 |

Percentage change |

| Total revenue |

36.896 |

32.138 |

14.80% |

| Total expenses* |

(29.581) |

(24.269) |

21.89% |

| Net profit after tax |

7.315 |

7.869 |

-7.04% |

| All figures in OMR millions |

3 months period ended 31 March 2015 |

3 months period ended 31 March 2014 |

Percentage change |

| Total revenue |

16.813 |

14.889 |

12.92% |

| Total expenses* |

(14.092) |

(12.371) |

13.91% |

| Net profit after tax |

2.721 |

2.518 |

16.90% |

| The Board of Directors of Sembcorp Salalah Power & Water Company SAOG (“the Company”) is delighted to invite the shareholders of the Company to attend the annual ordinary general meeting to be held at 3.00 p.m. on Monday 23 March 2015 at Hormuz Grand Hotel, Muscat to discuss the following agenda: |

| 1 To consider and approve the Report of the Board of Directors for the financial year ended 31 December 2014. |

| 2 To consider and approve the Corporate Governance Report for the financial year ended 31 December 2014. |

| 3 To consider the Auditor’s Report and approve the financial statements (Balance Sheet and Profit and Loss Account) for the financial year ended 31 December 2014. |

| 4 To consider and approve the recommendation to distribute cash dividends at the rate of 4.2% of the capital (42 baizas per share) to shareholders listed in the shareholders’ register maintained by the Muscat Clearing and Depository Company SAOC as at 1 April 2015. |

| 5 To consider and ratify the directors’ and committees’ sitting fees for the previous financial year and determine the sitting fees for the next financial year. |

| 6 To consider and approve directors’ remuneration amounting to RO 84,800 for the financial year ended on 31 December 2014. |

| 7 To consider and ratify the related party transactions entered into during the financial year ended on 31 December 2014. |

| 8 To consider and approve the related party transactions proposed to be entered into during the financial year ending on 31 December 2015. |

| 9 To inform the meeting of the donations made to support community services during the financial year ended on 31 December 2014. |

| 10 To consider and approve a proposal to spend the total sum of RO 42,000 to support community services during the financial year ending on 31 December 2015. |

| 11 To appoint the auditors of the Company for the financial year ending on 31 December 2015 and determine their fees. |

| Pursuant to the Articles of Association of the Company, any shareholder has the right to appoint a proxy in writing to attend and vote on decisions taken on his behalf. The proxy should carry the authorised proxy card attached with the notice to attend the general meeting as issued by Muscat Clearing and Depository Company SAOC. If the shareholder is a natural person, he is required to attach with the proxy card a copy of ID for adults, passport for females and minors who do not have an ID card, and resident cards or passports for expatriates. If the shareholder is a juristic person, the proxy card shall be signed by an authorised signatory and sealed with the company’s seal and submitted together with a copy of the commercial registration certificate and authorised signatories form. |

| All invitees are requested to attend the meetings at least half an hour before the meeting time. |

| If you have any inquiries kindly contact Tariq Bashir on telephone number 93215022. |

|

Unaudited 2014 |

Audited 2013 |

||||

|

RO |

RO |

||||

| Revenue |

|

62,770,756 |

62,711,862 |

||

|

|

|||||

| Cost of sales |

|

(29,186,960) |

(29,074,676) |

||

| Gross profit |

|

33,583,796 |

33,637,186 |

||

|

|

|||||

| Administrative and general expenses |

|

(1,059,824) |

(1,073,617) |

||

| Other income |

1,683,569 |

6,184,900 |

|||

| Operating profit |

|

34,207,541 |

38,748,469 |

||

|

|

|||||

| Finance income |

|

134,307 |

54,117 |

||

| Finance costs |

|

(19,776,946) |

(23,977,012) |

||

| Profit before tax |

|

14,564,902 |

14,825,574 |

||

|

|

|||||

| Income tax |

|

(1,751,602) |

(3,689,533) |

||

| Profit after tax |

|

12,813,300 |

11,136,041 |

||

|

|

|||||

| Other comprehensive (loss) income, net of income tax: |

|

||||

| Item that are or may be classified to profit or loss |

|

||||

| Effective portion of change in fair value of cash flow hedge |

|

(3,263,949) |

18,702,625 |

||

| Total comprehensive (loss) income for the year |

|

9,549,351 |

29,838,666 |

||

| Earnings per share: | |||||

| Basic earnings per share |

0.13 |

0.12 |

|

OMR 53 million raised in Oman’s largest IPO of 2013 |

| Muscat, 26 September 2013 – Sembcorp Salalah Power & Water Company SAOG (under transformation) (Sembcorp Salalah or the Company), a leading power and water company based in the Dhofar Governorate of Oman, today announced the successful closure of its initial public offering of 35% of the total share capital, or 33,410,019 existing ordinary shares, at a price of OMR 1.590 per share. The issue was opened for subscription on 28 August 2013 and closed on 26 September 2013. |

| The offering, which raised OMR 53 million, making it the largest in Oman this year as well as one of the largest in the region, was comfortably oversubscribed and attracted strong levels of demand from both retail and institutional investors across the Sultanate, the GCC and Europe. This implies an opening market capitalisation of OMR 152 million. Trading of the company’s shares is set to commence on the Muscat Securities Market on or around 10 October 2013. |

| HSBC Bank Oman SAOG acted as Issue Manager for the offering. HSBC Bank Middle East Limited acted as Sole Global Coordinator and Bookrunner. |

| Commenting on the offer close, Mr Lim Yeow Keong, Chief Executive Officer of Sembcorp Salalah, said, “We are delighted by the response we have received from such a wide range of investors in Oman and across the region. The overwhelming support and warm welcome we have received reflects the confidence in Sembcorp Salalah’s stable business model and recognises this unique opportunity to invest in an established operator with strong government support and strong predictability of cash flows.” |

| “We are thrilled to welcome our new investors to the Sembcorp Salalah shareholder register and we look forward to delivering on our commitment to meet the Dhofar region’s growing and long-term power and water demand.” |

| Muscat, 18 September 2013 – Sembcorp Salalah Power & Water Company (“Sembcorp Salalah” or “the Company”), a leading power and water company based in the Dhofar Governorate of Oman, has begun the countdown to the completion of its Initial Public Offering (IPO), which launched on 28 August. The IPO, which has seen strong interest from investors across the Sultanate and the broader Gulf region, closes for subscription on 26 September 2013. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The IPO of 33,410,019 existing ordinary shares represents 35% of the issued share capital of Sembcorp Salalah. The shares will be priced at OMR 1.590 per share, inferring a total offer size of OMR 53 million and a market capitalisation on listing of OMR 152 million. The offering is expected to be the biggest in Oman this year. It is proposed that the shares will be admitted to trading on the Muscat Securities Market on or around 10 October 2013. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| HSBC Bank Middle East Limited is the Sole Global Coordinator and Bookrunner. HSBC Bank Oman SAOG is the Issue Manager. Retail investors with an interest in participating in the IPO are encouraged to complete and submit their applications in any of the Collecting Banks which include Bank Muscat, Oman Arab Bank, National Bank of Oman and Bank Dhofar. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commenting on the IPO, Mr Lim Yeow Keong, Chief Executive Officer of Sembcorp Salalah, said, “With only one week to go until our share offer closes, investors in Oman have a limited period in which to participate in our IPO. We are very excited by the widespread positive investor sentiment and significant interest in the Sembcorp Salalah offer that we have seen over the past three weeks. During this time we have presented investors across Oman and the broader Gulf region with a fantastic opportunity to invest in an established operator with strong predictability of cash flows that will result in stable recurring income, a highly attractive dividend yield and opportunities for growth.” | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| “As we enter the final week of the subscription period, we are still seeing a strong level of demand for the offer, and I look forward to a successful completion on the 26 September.” | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| About the IPO | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| About Sembcorp Salalah: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Business Highlights:

Strong predictability of stable cash flows:

|

|

| Muscat, 28 August 2013 – Sembcorp Salalah Power & Water Company SAOG (under transformation) (Sembcorp Salalah or the Company), a leading power and water company based in the Dhofar Governorate of Oman, today launched its Initial Public Offering (IPO) of 33,410,019 existing ordinary shares, representing 35% of the issued share capital of Sembcorp Salalah. Shares are priced at OMR 1.590 per ordinary share. The IPO is now open for subscription until 26 September 2013. |

| The IPO is expected to raise around OMR 53 million, which would make it the biggest share offer in Oman so far in 2013. The existing shareholders, Sembcorp Utilities, Oman Investment Company (OIC) and BDCC Investment Company, are required to undertake this IPO and make 35% of the Company’s shares available to the public as the IPO is a condition under the Project Founders’ Agreement. |

| Highlights: |

| • | IPO of 35% of the issued share capital of Sembcorp Salalah |

| • | Offer runs from 28 August 2013 to 26 September 2013 |

| • | Offer open to individual investors, juristic persons and institutions within Oman, and to non-Omani investors outside of US, Canada, Australia, South Africa, Republic of Ireland and Japan |

| • | Shares priced at OMR 1.590 per share |

| • | Offer size of OMR 53 million |

| • | Market capitalisation on listing of OMR 152 million |

| • | First day of trading expected to be around 10 October 2013 |

| • | Further information available from the Issue Manager, HSBC Bank Oman SAOG; the following Collecting Banks: Bank Muscat, Oman Arab Bank, National Bank of Oman and Bank Dhofar; as well as at a dedicated IPO website: www.ttct.net/sembcorp-demo-1/ipo |

| • | The offer period will commence on 28 August 2013 and end on 26 September 2013 at the end of the working hours of the Collecting Banks. It is proposed that the shares will be admitted to trading on the Muscat Securities Market on or around 10 October 2013. |

| • | The offer is open to Omani and non-Omani individual investors, juristic persons and institutions through two categories. |

| • | The minimum subscription for Category I investors is 100 shares and in multiples of 100 shares thereafter. For Category II investors, the minimum subscription is 50,100 shares and in multiples of 100 shares thereafter. |

| • | The maximum subscription for Category I investors is 50,000 shares. For Category II investors, the maximum subscription is 10% of the size of the share offer, which equates to 3,341,000 shares. |

| • | Shares are allocated on a proportionate basis and must be 100% pre-funded at the Collecting Banks at the time of subscription. |

| • | The IPO Prospectus, Articles of Association and Application Forms will be available from the following Collecting Banks throughout the offer period: Bank Muscat, Oman Arab Bank, National Bank of Oman and Bank Dhofar. There is also an IPO section on the Sembcorp Salalah website www.ttct.net/sembcorp-demo-1/ipo, which contains information about the Company and the IPO as well as downloadable copies of the IPO Prospectus and the summary Offer Pamphlet. |

| • | Sembcorp Salalah developed, owns and operates an electricity generation and seawater desalination plant, the Salalah Independent Water and Power Plant, located between Taqah and Mirbat in Oman. The plant is located approximately 50 kilometres from Salalah, the administrative town in the Dhofar Governorate. |

| • | The plant has been in full commercial operation since 25 May 2012 and has a contracted power capacity of 445 megawatts (MW) and a contracted water capacity of 15 million imperial gallons per day (MiGD). It consists of a gas-fired combined cycle power plant and a reverse osmosis seawater desalination plant. |

| • | As of the date of this announcement, Sembcorp Salalah supplies approximately 72% of the power dispatch and 100% of the net installed water capacity of the Dhofar Governorate. |

| • | The Company has invested approximately US$1 billion to develop, finance, build, own and operate the plant. It generates its revenues in accordance with a 15-year power and water purchase agreement (PWPA) with the Oman Power and Water Procurement Company (OPWP), which is indirectly wholly-owned by the Omani government. |

| • | As the largest and most energy-efficient power and water plant in the Dhofar Governorate, the Salalah Independent Water and Power Plant is expected to play a major role in meeting the growing power and water demand of the region into the foreseeable future and beyond. |

| • | Sembcorp Salalah is currently 60% owned by Sembcorp Utilities, a wholly-owned subsidiary of Singapore-based Sembcorp Industries, 35% owned by OIC and 5% owned by BDCC Investment Company. |

| • | Sembcorp Salalah has strong predictability of cash flows that are not affected by the amount of power and water actually required by OPWP as the Company is paid on an availability basis, based on the power and water that is made available. |

| • | Under the PWPA, Sembcorp Salalah is entitled to receive capacity charges from OPWP for 100% of the available power and water capacity of the plant, which comprise approximately 90% of the total revenue of Sembcorp Salalah. These capacity charges are payable by OPWP regardless of whether the actual output of the plant is dispatched by OPWP. |

| • | Sembcorp Salalah’s project represents one of 12 independent power and/or water production projects to be implemented by the government through OPWP on a “build, own and operate” basis and benefits from a well-established contractual framework. |

| • | The power and water sectors are of high strategic importance to the Dhofar Governorate and Oman as a whole. As of July 2013, the plant’s capacity constitutes approximately 72% of the power dispatch and 100% of the net installed water capacity of the Dhofar Governorate. |

| • | Given the projected growth in electricity and water demand, the plant is expected to remain critical to the continued supply of power and water in the Dhofar Governorate in the long term. |

| • | The plant is completed and has been in full commercial operation for over 14 months. In addition, Sembcorp Salalah benefits from minimal operating risk as its operator, Sembcorp Salalah O&M Services Company (Sembcorp Salalah O&M), is a joint venture indirectly owned by the Project Sponsors, Sembcorp Utilities and OIC, creating an alignment of interests which ensures that the plant is operated efficiently. |

| • | Sembcorp Salalah O&M is managed locally and benefits from the procedures and expertise of Sembcorp Utilities, which is well established in the region and has a demonstrated track record of running similar plants, with facilities of over 5,900 MW of power capacity and over 1,500 MiGD of water in operation and under development globally. |

| • | Management believes that the excess of actual capacity over the contracted capacity of the plant will more than compensate for the estimated degradation of the plant over the term of the PWPA. |

| • | The PWPA also allows Sembcorp Salalah to perform maintenance on the power plant at designated off-peak periods of the year. This contemplated maintenance is likely to extend the lifespan of the plant and delay the degradation of its electricity and desalinated water capacity. |

| • | Under the natural gas sales agreement between Sembcorp Salalah and the Ministry of Oil & Gas, the plant has mitigated risks associated with gas quality, gas supply and gas price. In the event that natural gas is not available, and provided that Sembcorp Salalah is not in breach of its obligations regarding the operations of the plant, Sembcorp Salalah is still entitled to receive its incremental costs for the use of diesel from the Ministry of Oil & Gas and capacity charges from OPWP. |

| • | Sembcorp Salalah benefits from the extensive water and energy experience of the Project Sponsors. Sembcorp Utilities is a leading energy, water and on-site logistics group with a strong track record in identifying, securing, financing and executing energy and water projects and has a number of strategic relationships and long-term partnerships with multinational customers. OIC is a private equity investment company with strong experience of investing in the region and a diversified portfolio of investments in the oil and gas, petrochemical, construction and manufacturing sectors in Oman. |

| • | The project is strategically important to the Project Sponsors, who provide Sembcorp Salalah with technological and management capabilities and expertise that are critical to its operational success. |

| • | Sembcorp Salalah has the advantage of well-trained and experienced personnel, who bring extensive management expertise and the knowledge sharing of know-how accumulated through decades of experience. Sembcorp Salalah personnel are also able to attend training and off-site sessions with personnel of the Project Sponsors around the world in order to share and exchange knowledge and best practices. |

| • | Sembcorp Salalah has two key opportunities for incremental growth of revenues: |

| i. The expansion of existing facilities to deliver additional desalinated water capacity, in line with the current government policy to minimise use of groundwater, and | |

| ii. The sale of current excess power capacity. |

| • | IPO of 35% of the issued share capital of Sembcorp Salalah |

| • | Sembcorp Salalah is undertaking the IPO to comply with the obligations stipulated in the Project Founders’ Agreement |

| • | HSBC Bank Middle East Limited is the Sole Global Coordinator and Bookrunner. HSBC Bank Oman SAOG is the Issue Manager |

| • | Offer runs from 28 August 2013 to 26 September 2013 |

| • | Offer open to individual investors, juristic persons and institutions within Oman, and to non-Omani investors outside of US, Canada, Australia, South Africa, Republic of Ireland and Japan |

| • | Shares priced at OMR 1.590 per share |

| • | Offer size of OMR 53 million |

| • | Market capitalisation on listing of OMR 152 million |

| • | First day of trading expected to be around 10 October 2013 |

| • | Further information available from the Issue Manager, HSBC Bank Oman SAOG; the following Collecting Banks: Bank Muscat, Oman Arab Bank, National Bank of Oman and Bank Dhofar; as well as at a dedicated IPO website: www.ttct.net/sembcorp-demo-1/ipo |

| • | Sembcorp Salalah developed, owns and operates an electricity generation and seawater desalination plant, the Salalah Independent Water and Power Plant, located between Taqah and Mirbat in Oman. The plant is located approximately 50 kilometres from Salalah, the administrative town in the Dhofar Governorate. |

| • | The plant has been in full commercial operation since 25 May 2012 and has a contracted power capacity of 445 megawatts (MW) and a contracted water capacity of 15 million imperial gallons per day (MiGD). It consists of a gas-fired combined cycle power plant and a reverse osmosis seawater desalination plant. |

| • | As of the date of this announcement, Sembcorp Salalah supplies approximately 72% of the power dispatch and 100% of the net installed water capacity of the Dhofar Governorate. |

| • | The Company has invested approximately US$1 billion to develop, finance, build, own and operate the plant. It generates its revenues in accordance with a 15-year power and water purchase agreement (PWPA) with the Oman Power and Water Procurement Company (OPWP), which is indirectly wholly-owned by the Omani government. |

| • | As the largest and most energy-efficient power and water plant in the Dhofar Governorate, the Salalah Independent Water and Power Plant is expected to play a major role in meeting the growing power and water demand of the region into the foreseeable future and beyond. |

| • | Sembcorp Salalah is currently 60% owned by Sembcorp Utilities, a wholly-owned subsidiary of Singapore-based Sembcorp Industries, 35% owned by OIC and 5% owned by BDCC Investment Company. |

| • | Sembcorp Salalah has strong predictability of cash flows that are not affected by the amount of power and water actually required by OPWP as the Company is paid on an availability basis, based on the power and water that is made available. |

| • | Under the PWPA, Sembcorp Salalah is entitled to receive capacity charges from OPWP for 100% of the available power and water capacity of the plant, which comprise approximately 90% of the total revenue of Sembcorp Salalah. These capacity charges are payable by OPWP regardless of whether the actual output of the plant is dispatched by OPWP. |

| • | Sembcorp Salalah’s project represents one of 12 independent power and/or water production projects to be implemented by the government through OPWP on a “build, own and operate” basis and benefits from a well-established contractual framework. |

| • | The power and water sectors are of high strategic importance to the Dhofar Governorate and Oman as a whole. As of July 2013, the plant’s capacity constitutes approximately 72% of the power dispatch and 100% of the net installed water capacity of the Dhofar Governorate. |

| • | Given the projected growth in electricity and water demand, the plant is expected to remain critical to the continued supply of power and water in the Dhofar Governorate in the long term. |

| • | The plant is completed and has been in full commercial operation for over 14 months. In addition, Sembcorp Salalah benefits from minimal operating risk as its operator, Sembcorp Salalah O&M Services Company (Sembcorp Salalah O&M), is a joint venture indirectly owned by the Project Sponsors, Sembcorp Utilities and OIC, creating an alignment of interests which ensures that the plant is operated efficiently. |

| • | Sembcorp Salalah O&M is managed locally and benefits from the procedures and expertise of Sembcorp Utilities, which is well established in the region and has a demonstrated track record of running similar plants, with facilities of over 5,900 MW of power capacity and over 1,500 MiGD of water in operation and under development globally. |

| • | Management believes that the excess of actual capacity over the contracted capacity of the plant will more than compensate for the estimated degradation of the plant over the term of the PWPA. |

| • | The PWPA also allows Sembcorp Salalah to perform maintenance on the power plant at designated off-peak periods of the year. This contemplated maintenance is likely to extend the lifespan of the plant and delay the degradation of its electricity and desalinated water capacity. |

| • | Under the natural gas sales agreement between Sembcorp Salalah and the Ministry of Oil & Gas, the plant has mitigated risks associated with gas quality, gas supply and gas price. In the event that natural gas is not available, and provided that Sembcorp Salalah is not in breach of its obligations regarding the operations of the plant, Sembcorp Salalah is still entitled to receive its incremental costs for the use of diesel from the Ministry of Oil & Gas and capacity charges from OPWP. |

| • | Sembcorp Salalah benefits from the extensive water and energy experience of the Project Sponsors. Sembcorp Utilities is a leading energy, water and on-site logistics group with a strong track record in identifying, securing, financing and executing energy and water projects and has a number of strategic relationships and long-term partnerships with multinational customers. OIC is a private equity investment company with strong experience of investing in the region and a diversified portfolio of investments in the oil and gas, petrochemical, construction and manufacturing sectors in Oman. |

| • | The project is strategically important to the Project Sponsors, who provide Sembcorp Salalah with technological and management capabilities and expertise that are critical to its operational success. |

| • | Sembcorp Salalah has the advantage of well-trained and experienced personnel, who bring extensive management expertise and the knowledge sharing of know-how accumulated through decades of experience. Sembcorp Salalah personnel are also able to attend training and off-site sessions with personnel of the Project Sponsors around the world in order to share and exchange knowledge and best practices |

| • | Sembcorp Salalah has two key opportunities for incremental growth of revenues: |

| i. The expansion of existing facilities to deliver additional desalinated water capacity, in line with the current government policy to minimise use of groundwater, and | |

| ii. The sale of current excess power capacity. | |

| • | The offer period will commence on 28 August 2013 and end on 26 September 2013 at the end of the working hours of the Collecting Banks. It is proposed that the shares will be admitted to trading on the Muscat Securities Market on or around 10 October 2013. |

| • | The offer is open to Omani and non-Omani individual investors, juristic persons and institutions through two categories. |

| • | The minimum subscription for Category I investors is 100 shares and in multiples of 100 shares thereafter. For Category II investors, the minimum subscription is 50,100 shares and in multiples of 100 shares thereafter. |

| • | The maximum subscription for Category I investors is 50,000 shares. For Category II investors, the maximum subscription is 10% of the size of the share offer, which equates to 3,341,000 shares. |

| • | Shares are allocated on a proportionate basis and must be 100% pre-funded at the Collecting Banks at the time of subscription. |

| • | The IPO Prospectus, Articles of Association and Application Forms will be available from the following Collecting Banks throughout the offer period: Bank Muscat, Oman Arab Bank, National Bank of Oman and Bank Dhofar. There is also an IPO section on the Sembcorp Salalah website www.ttct.net/sembcorp-demo-1/ipo, which contains further information. |